Peer Suite’s FEMA National Risk Index Map

Credit unions aren’t just financial institutions, they are trusted community and member partners. Understanding and preparing for natural hazards is essential to protecting members, businesses, and neighborhoods.

That’s where Peer Suite’s FEMA National Risk Assessment Map comes in.

This interactive map leverages FEMA’s National Risk Index (NRI) dataset and integrates it with census data and Callahan's branch data within Peer Suite's Market Share Reporting section.

Market Share Reporting maps are available only to users on Peer Suite's Plus level. Think your team could benefit from this tool? Schedule a conversation with your account manager.

This map helps credit unions to:

- Ensure financial stability by assessing risk when making lending decisions.

- Support members in disaster-prone areas with proactive outreach and relief programs.

- Strengthen branch strategy to serve communities safely and sustainably.

By visualizing risk at the county and census tract level, credit unions can build financial resilience within their communities, before disaster strikes.

What This Guide Covers

- Navigating Peer's Risk Assessment Map

- How the FEMA Risk Index works

- Next Steps: Leveraging Peer's National Risk Assessment Map

Jump to a section above to learn more.

Navigating Peer's Risk Assessment Map

The FEMA National Risk Assessment Map is an interactive feature available exclusively at the Plus level of Peer Suite, found in the Market Share Reporting section via the left navigation.

Getting Started

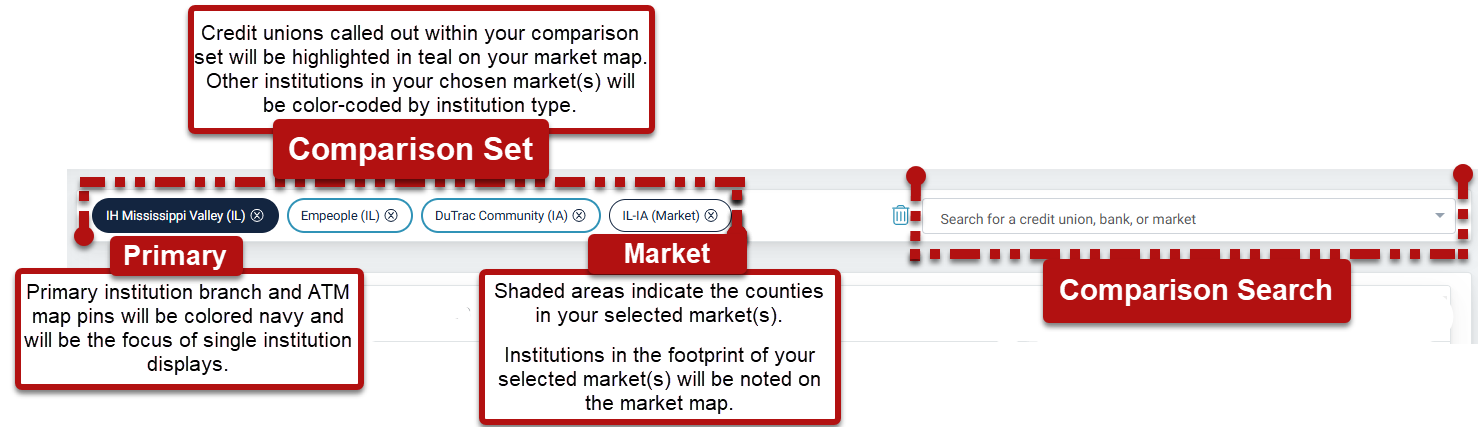

Begin by selecting your Comparison Set, which will define the data shown on the Risk Assessment Map.

- Include local, regional, or national markets to analyze risk areas.

- Include individual credit unions or banks to highlight institutions of interest on the map.

Looking to learn more about markets? Check out these linked guides to explore available built-in market options and how to create custom markets tailored to your strategy.

Key Map Features

- Market Boundaries: Shaded areas represent the counties in your selected market(s). Adjust or add markets via your comparison set to focus on specific regions.

Peer Pointer!

Census tracts will be outlined within your selected counties on your market map to provide a granular view of risk levels.

- FEMA Risk Index: Each census tract is color-coded to indicate assessed risk levels.

- Branch Pins: The map displays branches with the following pin colors:

- Navy pins: Your primary's branches

- Teal pins: Credit Unions called out in your comparison set with branches in your market.

- Light grey pins: All other credit union branches in your market

- Red pins: Bank branches in your market.

Peer Pointer!

Use the checkboxes in the top-right corner of the map to include/exclude branch and credit union ATM pins.

- Branch & Tract Snapshots: Hover over a branch pin or census tract to see key data points.

- Triangle CU ATM Pins: These represent freestanding credit union ATMs, while in-branch ATMs will appear in the “Branch Snapshot.” ATM data is specific to credit unions.

Understanding the FEMA's National Risk Index

What is the National Risk Index?

The National Risk Index (NRI) is a FEMA tool that helps communities and businesses assess their risk from natural hazards. It provides a standardized way to measure risk at the county and census tract level based on:

- Hazard Exposure – How frequently disasters occur in an area.

- Historical Loss Data – Trends in past damage and financial losses.

- Annualized Frequency – The likelihood of recurring events.

Key Factors in the National Risk Index

The NRI measures risk by analyzing three primary factors:

- Expected Annual Loss (EAL)

- This factor estimates the potential financial losses from natural hazards. It takes into account the historical damage caused by such events and provides a prediction for future losses.

- Social Vulnerability

- Social vulnerability refers to how socioeconomic factors, such as poverty, age, or housing conditions—affect a community’s ability to withstand and recover from disasters. Communities with higher social vulnerability may experience higher risk ratings, as they tend to have fewer resources for disaster preparedness and recovery.

- Community Resilience

- This measures how well a community can prepare for, respond to, and recover from disasters. Communities with stronger resilience are generally better equipped to mitigate potential losses, resulting in lower overall risk ratings.

For credit unions, understanding these factors can support risk assessment, emergency planning, and community outreach efforts.

Natural Hazards Included in the National Risk Index

- The National Risk Index evaluates risk from 18 natural hazards, including:

- Flooding (Coastal & Riverine)

- Severe Storms (Tornadoes, Hurricanes, Strong Winds, Hail, Lightening)

- Environmental Stress (Wildfires, Drought, Heat wave)

- Cold Weather (Winter Weather, Ice Storms, Cold Waves, Avalanche)

- Geological Hazards (Earthquakes, Landslides, Tsunamis, Volcanic Activity)

Peer Pointer!

While some natural hazards can trigger secondary events (e.g., volcanic ash from an eruption), the Index only considers primary hazards.

The NRI helps communities better understand their exposure, potential impacts, and preparedness needs.

Want to learn more about this data set? Explore these FEMA resources:

Next Steps: Leveraging Peer's Risk Assessment Map

Credit unions play a vital role in financial security and community resilience. By integrating findings from Peer Suite's FEMA’s National Risk Assessment Map into strategic planning, credit unions can take proactive steps to protect their members and strengthen their communities. Here’s how to get started:

- Integrate Risk Data into Strategic Planning

- Assess geographic risk levels to align services and infrastructure with community needs.

- Incorporate risk data into board meetings, strategic discussions, and long-term planning.

- Enhance Risk-Based Lending Strategies

- Adjust lending policies, loan pricing, and reserve allocations based on risk exposure.

- Develop disaster recovery loan programs to support impacted members.

- Optimize Branch & Infrastructure Planning

- Use risk data to select lower-risk locations for branches and access points (ATMs, mobile branches).

- Overlay FEMA risk data with existing branch locations to identify vulnerabilities.

- Strengthen Business Continuity & Disaster Preparedness

- Implement contingency plans to ensure uninterrupted services in disaster-prone areas.

- Review remote service capabilities and emergency response protocols.

- Expand Member Support & Community Outreach

- Provide disaster preparedness education tailored to high-risk communities.

- Partner with local organizations for emergency relief and financial assistance programs.

With Peer Suite’s FEMA Map, credit unions can proactively protect, support, and empower their members and communities before, during, and after disasters.

Take Action with Peer Suite’s FEMA Map

With Peer Suite's FEMA’s National Risk Assessment Map credit unions have a powerful tool to integrate risk assessment into everyday operations. By taking these next steps, credit unions can proactively safeguard their members, reinforce financial stability, and build resilient communities.

Want to explore more of Market Share Reporting's Features? Check out the guides below: